Turbotax Business is available for Windows operating systems only.

TurboTax 2023 – File your taxes with 100% confidence.

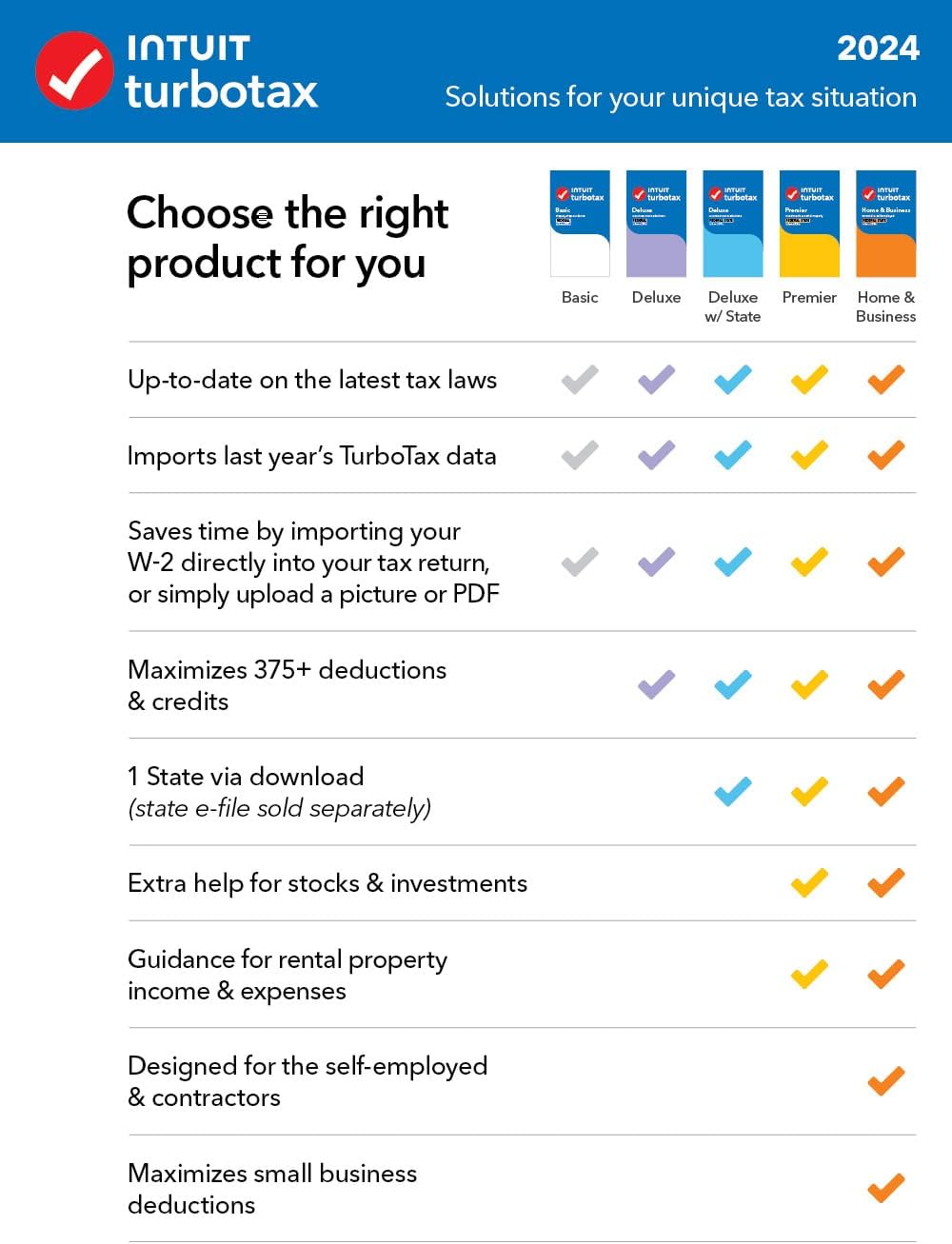

TurboTax is tailored to your unique situation. It searches hundreds of deductions and credits and handles even the most difficult tax situations, so you can be confident you’re getting every dollar you deserve.

- Includes 5 federal e-files. Business State is sold separately via download. Free U.S.-based product support (Timing may vary).

- Your downloaded software stays on your computer so that you can view and manage your tax data (Intuit account required)

- Boost your profits with industry-specific small business tax deductions

- Stay up to date with the latest tax laws so you have the latest information

- Create and e-file W-2s and 1099s for your staff people and contractors using Quick Employer Forms

- Electronically create K-1 forms in PDF format

- Save time with streamlined asset depreciation & reporting

- Includes audit alerts that flag areas that may trigger an IRS audit

TurboTax Business 2023 tax software is the perfect solution for small business owners looking for an easy and efficient way to file their federal tax returns.

With TurboTax Business, you can maximize your business tax deduction and get the most benefit from your tax return. Our software guides you step-by-step through the process, ensuring you never miss an opportunity to save.

TurboTax Business 2023 includes everything you need to file your business taxes accurately and efficiently. Our software is designed specifically for small businesses and includes all the forms and schedules you need to file your federal tax return.

In addition to maximizing your tax deductions, TurboTax Business helps you stay organized throughout the year. Our software keeps track of your expenses and income, so you can easily access all your financial information when it comes time to file your taxes.

With TurboTax Business 2023, you can file your federal tax return with confidence knowing you’re getting the maximum refund possible. Our software is accurate and reliable, ensuring your taxes are filed correctly and on time.

Don’t let tax season get the better of you. Get organized and easily file your federal tax returns using TurboTax Business 2023 tax software. Download our PC software today and begin maximizing your business tax deductions.

TurboTax Business 2023 software is the ideal solution for corporations, LLCs, partnerships, and trusts that want to file their federal tax returns accurately and easily. This software is user-friendly and provides detailed guidance through every step of the process, making sure no details are missed.

With this software, you can easily import data from your QuickBooks account or financial institution, making the process much quicker and more efficient. In addition, you can file multiple returns simultaneously and get relevant deductions and credits for your business expenses.

TurboTax Business 2023 software is not only reliable and efficient but also makes sure that your returns meet all the required compliance standards. Additionally, with its Audit Defense feature, you can feel secure knowing that you can get professional representation in case of an IRS audit.

Finally, the software offers one-on-one support from TurboTax experts who can help you deal with any hurdles or confusion you may face while filing. With TurboTax Business 2023 software, you can easily file your federal tax return.

![TurboTax Business 2023 Software, Federal Tax Return [PC Download] Intuit](http://softwarediscountusa.com/cdn/shop/files/TurboTax-Business-2023-Software_-Federal-Tax-Return-_PC-Download_-Intuit-108007236.jpg?v=1703430754&width=679)