TurboTax Business is recommended if any of the following apply:

- Need to file a separate tax return for your business

- Have a partnership

- Own a S or C Corp

- Multi-Member LLC

- Manage a trust or estate

Turbotax Business 2022 Download [Old Version], Federal Return Only [PC Download] Windows Only

Digital download, no hard copy will be shipped.

This TurboTax product is for [Tax Year 2022] only. Make sure you are purchasing the correct year, as all sales for previous tax years are final. We cannot provide refunds or exchanges if you mistakenly order the wrong version. Please confirm your tax year needs before completing the purchase.

Save time with TurboTax Business State.

Easily transfer your federal tax info into Business State

Price per state with TurboTax Business

$55

Prepare and e-file with ease.

E-file now to get your fastest refund possible!*

TurboTax CD/Download Personal Returns

- Free Federal E-file Included — Free e-file of your federal tax return is included with your purchase of TurboTax CD/Download.

- E-file Multiple Returns — Prepare and e-file up to five (5) federal tax returns at no additional cost. (This is the maximum returns limit set by the IRS.)

- E-file State Return(s) — E-file your state returns for only $25 per state return.** You may e-file up to three (3) state returns per federal tax return.

- or Print and Mail Your Return(s) — Print as many copies of your federal and state returns as you need for free when you purchase TurboTax CD/Download.

TurboTax CD/Download Business Returns

- Free Federal E-file Included — Free e-file of your federal tax return is included with your purchase of TurboTax Business. Business State sold separately.

- E-file Multiple Returns — Prepare and e-file up to five (5) federal tax returns at no additional cost. (This is the maximum returns limit set by the IRS.)

*Fastest refund with e-file and direct deposit; refund timeframes will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

**The price is based on the date on which you e-file and is subject to change without notice. E-file fees do not apply to New York state returns.

WORKS ON

* The installation requires a minimum installation configuration. See System Requirements below

TurboTax Business Download 2022: Expert Guide for Your Small Business Taxes

Complete your business taxes the right way with TurboTax 2022

TurboTax Business is available only for Windows operating systems only.

TurboTax guides you every step of the way and double-checks your return, so you can be confident your business taxes are filed correctly.

-

Preparing and filing your business or trust taxes with confidence

- Includes 5 free federal e-files. The business state is sold separately.

- Stay up to date with the latest tax laws so you have the latest information

- Increase your income with industry-specific tax deductions

- Generate unlimited W-2, 1099-MISC, 1099-INT, and 1099-DIV forms for employees and contractors

-

Easily imports your data from QuickBooks Desktop (2020 and later) income and expense accounts and categorizes them for you

- Electronically create K-1 forms in PDF format

-

Save time with streamlined asset depreciation & reporting

-

Includes audit alerts that flag areas that could trigger an IRS audit

If you're a small business owner, you know how much work it takes to keep your finances organized. The last thing you want to do is spend hours trying to file your taxes yourself. That's where Turbotax Business Download 2022 comes in handy.

Turbotax Business is designed specifically for small business owners like you. With this software, you will get expert guidance at every step, from identifying deductions to filing forms. And because it's a download, you can use it at your own pace and on your schedule.

One of the best things about TurboTax Business Download 2022 is how simple it is to use. The software guides you through every step of the process, so you don't need to be a tax expert to get started. Plus, it's designed to catch errors and maximize your deductions, so you can rest assured you're getting the best possible results.

If you're concerned about filing your taxes correctly and on time, Turbotax Business is a great option. It includes all the forms and guidance you need to complete your federal tax return quickly and easily. And because it's a download, you can get started right away and file from the comfort of your home or office.

In short, if you are a small business owner and are looking for a reliable and easy-to-use tax preparation solution, Turbotax Business Download 2022 is the best choice for you. With expert guidance and helpful features, you can file your federal tax return with confidence, knowing you are getting the best possible results.

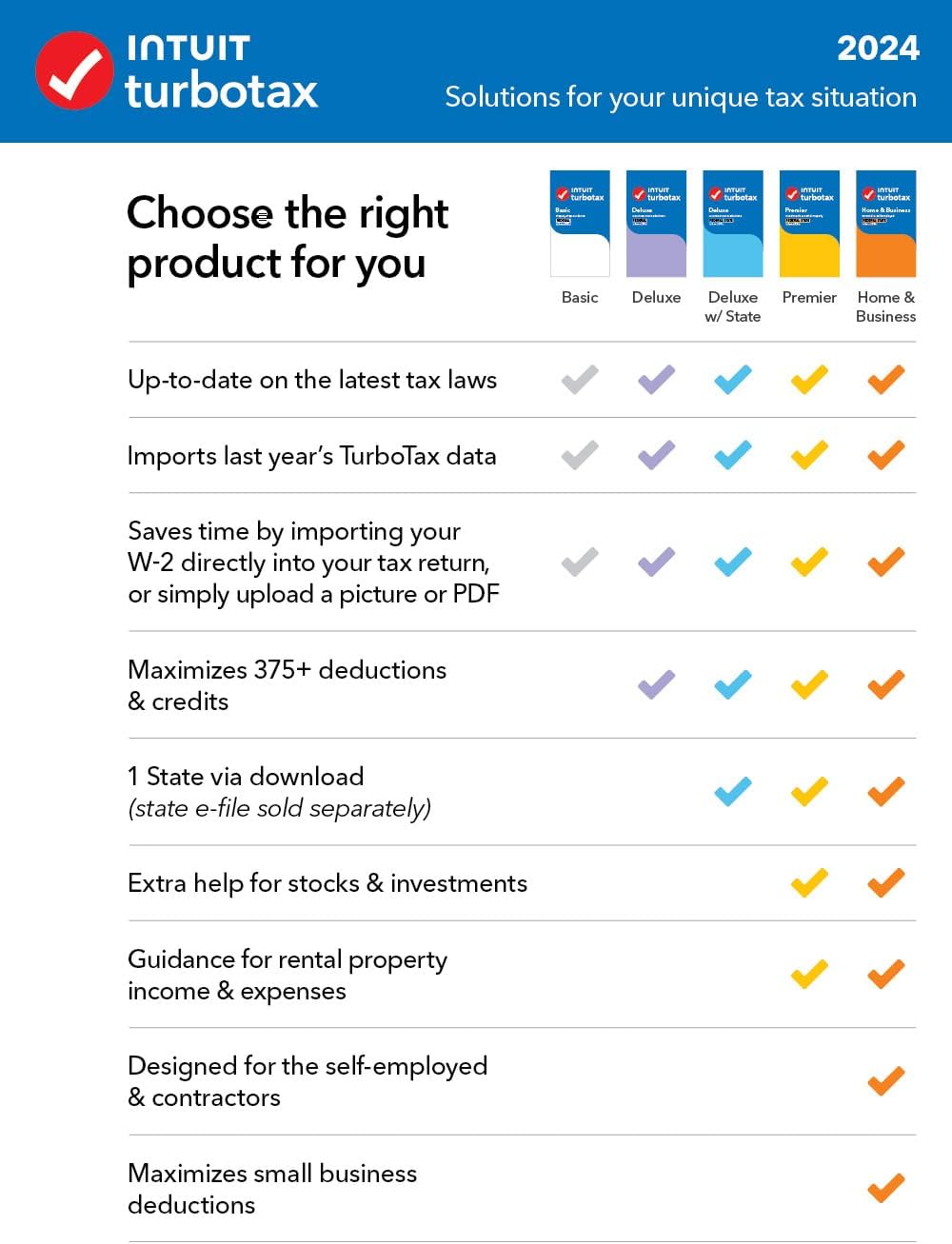

Searches over 350 tax deductions

- TurboTax finds every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

Double-checks your return

- TurboTax runs through thousands of error checks and double-checks your tax returns as you go to help make sure there are no mistakes.

100% accurate calculations

- TurboTax calculations are 100% accurate so your taxes will be done right, guaranteed, or we'll pay you any IRS penalties.

WINDOWS SYSTEM REQUIREMENTS

- OPERATING SYSTEMS: Windows 10 or later (Windows 8.1 not supported)

- MONITOR: 1024x768 or higher recommended.

- RAM: 2 GB or more recommended

- INTERNET CONNECTION: 1 Mbps modem (Broadband connection highly recommended). Required for product activation, software updates and optional online features.

- HARD DISK SPACE: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

- PRINTER: Any Windows-compatible inkjet or laser printer. Administrative rights required.

- THIRD PARTY SOFTWARE: Microsoft .NET 4.5.2 (included with TurboTax Installer)

| Corporation Income Tax Return Forms | |

|---|---|

|

1120

|

US Corporation Income Tax Return

|

|

1120-H

|

US Income Tax Return for Homeowners Associations

|

|

1120-W

|

Estimated Tax for Corporations

|

|

1120X

|

Amended US Corporation Income Tax Return

|

|

1125-A

|

Cost of Goods Sold

|

|

1125-E

|

Compensation of Officers

|

|

966

|

Corporate Dissolution or Liquidation

|

|

1139

|

Corporation Application for Tentative Refund

|

|

2220

|

Underpayment of Estimated Tax by Corporations

|

|

2553

|

Election by a Small Business Corporation

|

|

2848

|

Power of Attorney

|

|

3115

|

Application for Change in Accounting Method

|

|

3468

|

Investment Credit

|

|

3800

|

General Business Credit

|

|

4136

|

Credit for Federal Tax Paid on Fuels

|

|

4255

|

Recapture of Investment Credit

|

|

4562

|

Depreciation and Amortization

|

|

4684

|

Casualties and Thefts

|

|

4797

|

Sales of Business Property

|

|

5884

|

Work Opportunity Credit

|

|

6198

|

At-Risk Limitations

|

|

6252

|

Installment Sale Income

|

|

6478

|

Biofuel Producer Credit

|

|

6765

|

Credit for Increasing Research Activities

|

|

6781

|

Gains and Losses From Section 1256 Contracts and Straddles

|

|

7004

|

Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

|

|

8050

|

Direct Deposit of Corporate Tax Refund

|

|

8283

|

Noncash Charitable Contributions

|

|

8453-C

|

Declaration for an IRS e-file Return

|

|

8586

|

Low-Income Housing Credit

|

|

8594

|

Asset Acquisition Statement Under Section 1060

|

|

8609-A

|

Annual Statement for Low-Income Housing Credit

|

|

8822

|

Change of Address

|

|

8824

|

Like-Kind Exchange

|

|

8826

|

Disabled Access Credit

|

|

8827

|

Credit for Prior Year Minimum Tax

|

|

8832

|

Entity Classification Election

|

|

8834

|

Qualified Electric Vehicle Credit

|

|

8835

|

Renewable Electricity, Refined Coal, and Indian Coal Production Credit

|

|

8846

|

Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips

|

|

8850

|

Certification Request for Work Credits

|

|

8881

|

Credit for Small Employer Pension Plan Startup Costs

|

|

8990

|

Limitation on Business Interest Expense

|

|

8994

|

Paid Family and Medical Leave Credit

|

|

8903

|

Domestic Production Activities Deduction

|

|

8910

|

Alternative Motor Vehicle Credit

|

|

8916A

|

Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups

|

|

8925

|

Report of Employer-Owned Life Insurance Contracts

|

|

8938

|

Statement of Specified Foreign Financial Assets

|

|

8941

|

Credit for Small Employer Health Insurance Premiums

|

|

8949

|

Sales and Other Dispositions of Capital Assests

|

|

SS-4

|

Application for Employer Identification Number (EIN)

|

| Fiduciary Income Tax Return Forms | |

|---|---|

|

1041

|

US Income Tax Return for Estates and Trusts

|

|

1041-A

|

US Information Return Trust Accumulation of Charitable Amounts

|

|

1041-T

|

Allocation of Estimated Tax to Beneficiaries

|

|

1041-V

|

Payment Voucher

|

|

1041-ES

|

Estimated Income Tax for Estates and Trusts

|

|

56

|

Notice Concerning Fiduciary Relationship

|

|

1116

|

Foreign Tax Credit

|

|

2210

|

Underpayment of Estimated Tax by Individuals, Estates, and Trusts

|

|

2848

|

Power of Attorney

|

|

3115

|

Application for Change in Accounting Method

|

|

3800

|

General Business Credit

|

|

4136

|

Credit for Federal Tax Paid on Fuels

|

|

4255

|

Recapture of Investment Credit

|

|

4562

|

Depreciation and Amortization

|

|

4684

|

Casualties and Thefts

|

|

4797

|

Sales of Business Property

|

|

4952

|

Investment Interest Expense Deduction

|

|

6252

|

Installment Sale Income

|

|

6781

|

Section 1256 Contracts and Straddles

|

|

7004

|

Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

|

|

8453-FE

|

Declaration for an IRS e-file Return

|

|

8582

|

Passive Activity Loss Limitations

|

|

8594

|

Asset Acquisition Statement Under Section 1060

|

|

8801

|

Credit for Prior Year Minimum Tax-Individuals, Estates, and Trusts

|

|

8822

|

Change of Address

|

|

8824

|

Like-Kind Exchange

|

|

8855

|

Election to Treat a Qualified Revocable Trust as Part of an Estate

|

|

8868

|

Application for Extension of Time to File an Exempt Organization Return

|

|

8903

|

Domestic Production Activities Deduction

|

|

8938

|

Statement of Specified Foreign Financial Assets

|

|

8941

|

Credit for Small Employer Health Insurance Premiums

|

|

8949

|

Sales and Other Dispositions of Capital Assets

|

|

8960

|

Net Investment Income Tax

|

|

8990

|

Limitation on Business Interest Expense

|

|

8994

|

Paid Family and Medical Leave Credit

|

|

8995

|

Qualified Business Income Deduction - Simplified Computation

|

|

8995-A

|

Qualified Business Income Deduction

|

| Partnership Income Tax Return Forms | |

|---|---|

|

1065

|

US Return of Partnership Income

|

|

1065X

|

Amended Return or Administrative Adjustment Request (AAR)

|

|

1125-A

|

Cost of Goods Sold

|

|

2848

|

Power of Attorney

|

|

3115

|

Application for Change in Accounting Method

|

|

3468

|

Investment Credit

|

|

4562

|

Depreciation and Amortization

|

|

4684

|

Casualties and Thefts

|

|

4797

|

Sales of Business Property

|

|

5884

|

Work Opportunity Credit

|

|

6252

|

Installment Sale Income

|

|

6478

|

Biofuel Producer Credit

|

|

6765

|

Credit for Increasing Research Activities

|

|

6781

|

Gains and Losses From Section 1256 Contracts and Straddles

|

|

7004

|

Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

|

|

8283

|

Noncash Charitable Contributions

|

|

8308

|

Report of a Sale or Exchange of Certain Partnership Interests

|

|

8453-PE

|

US Partnership Declaration for an IRS e-file Return

|

|

8586

|

Low-Income Housing Credit

|

|

8594

|

Asset Acquisition Statement Under Section 1060

|

|

8609-A

|

Annual Statement for Low-Income Housing Credit

|

|

8822

|

Change of Address

|

|

8824

|

Like-Kind Exchange

|

|

8825

|

Rental Real Estate Income and Expenses of a Partnership or an S Corporation

|

|

8826

|

Disabled Access Credit

|

|

8832

|

Entity Classification Election

|

|

8835

|

Renewable Electricity, Refined Coal, and Indian Coal Production Credit

|

|

8846

|

Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips

|

|

8850

|

Certification Request for Work Credits

|

|

8881

|

Credit for Small Employer Pension Plan Startup Costs

|

|

8903

|

Domestic Production Activities Deduction

|

|

8910

|

Alternative Motor Vehicle Credit

|

|

8916A

|

Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups

|

|

8925

|

Report of Employer-Owned Life Insurance Contracts

|

|

8938

|

Statement of Specified Foreign Financial Assets

|

|

8941

|

Credit for Small Employer Health Insurance Premiums

|

|

8949

|

Sales and Other Dispositions of Capital Assets

|

|

8990

|

Limitation on Business Interest Expense

|

|

8994

|

Paid Family and Medical Leave Credit

|

|

SS-4

|

Application for Employer Identification Number (EIN)

|

| S Corporation Income Tax Return Forms | |

|---|---|

|

1120S

|

US Income Tax Return for an S Corporation

|

|

1125-A

|

Cost of Goods Sold

|

|

1125-E

|

Compensation of Officers

|

|

966

|

Corporate Dissolution or Liquidation

|

|

2220

|

Underpayment of Estimated Tax by Corporations

|

|

2553

|

Election by a Small Business Corporation

|

|

2848

|

Power of Attorney

|

|

3115

|

Application for Change in Accounting Method

|

|

3468

|

Investment Credit

|

|

4136

|

Credit for Federal Tax Paid on Fuels

|

|

4255

|

Recapture of Investment Credit

|

|

4562

|

Depreciation and Amortization

|

|

4684

|

Casualties and Thefts

|

|

4797

|

Sales of Business Property

|

|

5884

|

Work Opportunity Credit

|

|

6252

|

Installment Sale Income

|

|

6478

|

Biofuel Producer Credit

|

|

6765

|

Credit for Increasing Research Activities

|

|

6781

|

Gains and Losses From Section 1256 Contracts and Straddles

|

|

7004

|

Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

|

|

8050

|

Direct Deposit of Corporate Tax Refund

|

|

8283

|

Noncash Charitable Contributions

|

|

8453-S

|

Declaration for an IRS e-file Return

|

|

8586

|

Low-Income Housing Credit

|

|

8594

|

Asset Acquisition Statement Under Section 1060

|

|

8609-A

|

Annual Statement for Low-Income Housing Credit

|

|

8822

|

Change of Address

|

|

8824

|

Like-Kind Exchange

|

|

8825

|

Rental Real Estate Income and Expenses of a Partnership or an S Corporation

|

|

8826

|

Disabled Access Credit

|

|

8835

|

Renewable Electricity, Refined Coal, and Indian Coal Production Credit

|

|

8846

|

Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips

|

|

8850

|

Certification Request for Work Credits

|

|

8869

|

Qualified Subchapter S Subsidiary Election

|

|

8881

|

Credit for Small Employer Pension Plan Startup Costs

|

|

8903

|

Domestic Production Activities Deduction

|

|

8910

|

Alternative Motor Vehicle Credit

|

|

8916A

|

Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups

|

|

8925

|

Report of Employer-Owned Life Insurance Contracts

|

|

8938

|

Statement of Specified Foreign Financial Assets

|

|

8941

|

Credit for Small Employer Health Insurance Premiums

|

|

8949

|

Sales and Other Dispositions of Capital Assets

|

|

8990

|

Limitation on Business Interest Expense

|

|

8994

|

Paid Family and Medical Leave Credit

|