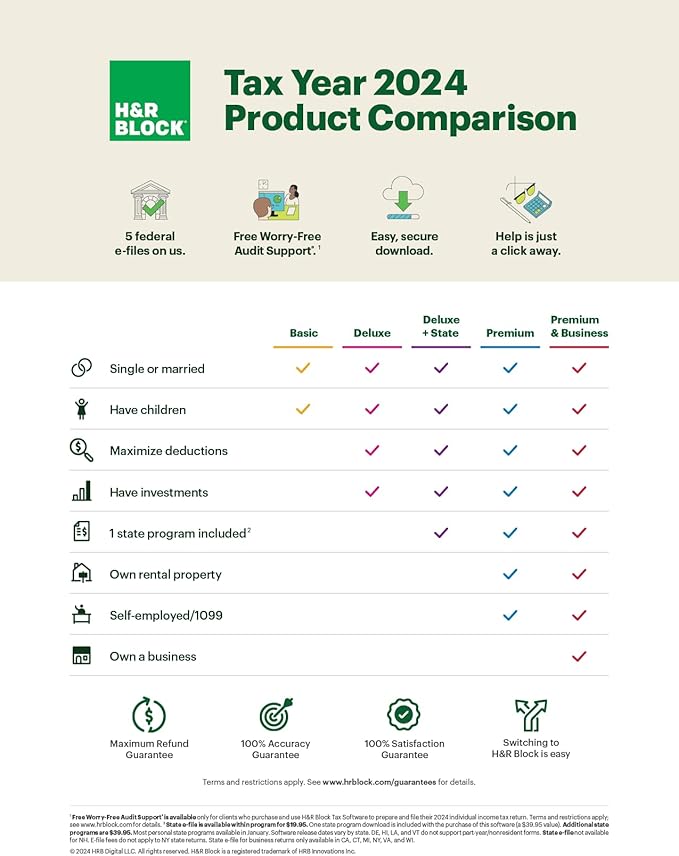

If you have a small business, choose Premium & Business tax software for guidance with corporations, partnerships, and LLCs.

- 1 federal program with 5 FREE federal e-files

- 1 state program (additional personal state programs are 39.95 dollars each)

- Most personal state programs available in January; release dates vary by state

- State e-file available for 19.95 dollars (state e-file not available in NH and fees do not apply to NY state returns)

- State e-file for business returns only available in CA, CT, MI, NY, VA, WI

H&R Block Tax Software Premium & Business 2024 for 1 User, Windows, Download

Digital download, no hard copy will be shipped.

$109.99

WORKS ON

PC: Windows 10 or later (Windows 8.1 not supported)

* The installation requires a minimum installation configuration. See System Requirements below

Recently Viewed Products

- Choosing a selection results in a full page refresh.

- Opens in a new window.

![TurboTax Business 2020, Federal Return Only [PC Download] Intuit](http://softwarediscountusa.com/cdn/shop/files/TurboTax-Business-2020_-Federal-Return-Only-_PC-Download_-Intuit-108007841.jpg?v=1703430760&width=679)